September is College Savings Month! Discovery Education’s collection of engaging content gives younger students the stepping stones to learning financial responsibility, while inspiring older students to think critically about their college plans and financial goals.

Making Plans for the Future

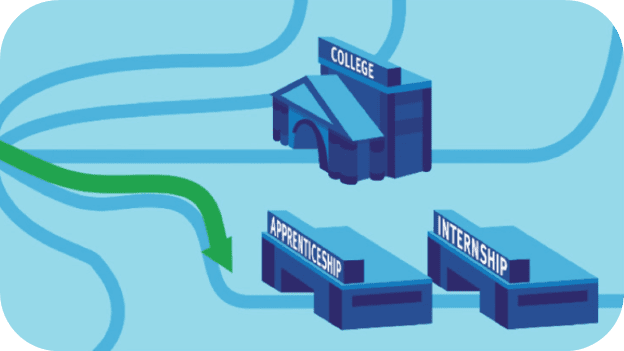

A major part of saving for college is thinking about the number of years a career path will need. Since some fields will require higher degrees than others, it’s important for students to narrow their focus to give their financial goals some clarity. Encourage students to explore different careers, then determine how they’ll need to prepare for these careers with higher education. Career profiles from the STEM Careers Coalition and Discover Data can help students envision themselves in different careers and guide their career goals.

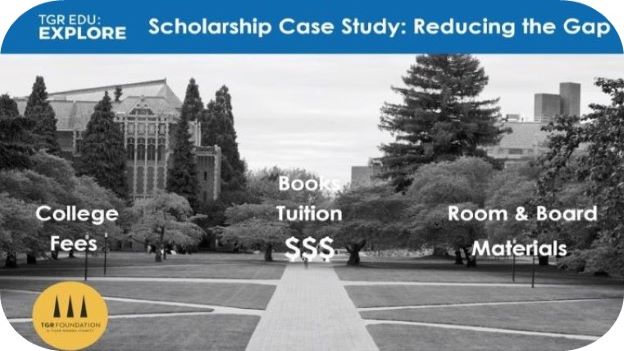

Once students determine a direction for their future, it’s time to focus on financials! Introduce students to technical programs, community colleges, public universities, and private universities to compare prices and programs. Encourage students to research different tuition rates, room and board costs, and estimate costs for books and materials.

Make family discussions about college planning easy with discussion guides from TGR EDU: Explore, a program with TGR Foundation, A Tiger Woods Charity. These resources will help older students (grades 6-12) understand the various types of financial aid, navigate the application process, and prioritize responsibilities for college admissions.

Personal Finance Support

Identifying and meeting financial goals can also lead to conversations on budgeting and personal financial choices. Lead students in grades K-2 through the Needs and Wants activity to help them determine what purchases should fit into a budget. The Premium Products hands-on activity in the Discover Data Channel helps students in grades 6-8 learn why some items cost more than others. Lastly. students can understand the financial effects of their choices with conversations around budgeting and behavioral economics lessons from Econ Essentials.

Explore how to make personal finances culturally relevant and interesting in the professional learning series from Pathway to Financial Success in Schools, developed with Discover Financial Services. Through these real-world educator stories, teachers see firsthand the benefits financial education can have on students. Plus, find more resources that offer additional step-by-step navigation to guide students in grades 6-12 on their financial and personal missions.

Find fun in financial literacy with Discover Venture Valley, a program with the Singleton Foundation for Financial Literacy and Entrepreneurship. Discover Venture Valley empowers students in grades 6-12 to build financial and business basics through gamified learning as they take on the role of a budding entrepreneur in the new Venture Valley video game.